145 CANDLESTICK PATTERNS PAGE 9 (17) Morning Star ( Bullish

The three white soldiers candlestick pattern is typically observed as a reversal indicator, often appearing after a period of price decline. This chart pattern suggests a strong change in.

3 Candlestick Patterns For Day Trading UnBrick.ID

This is the first part of a two-part look at Japanese candlestick formations that involve three candles. In this video, we show you four different patterns,.

Three+ Candle Patterns ChartPatterns Candlestick Stock Market

3. Bullish Engulfing Candlestick Pattern: - The bullish engulfing pattern is formed of two candlesticks. It is a chart pattern that forms when a small black candlestick is followed by a large white candlestick that completely eclipses or "engulfs" the previous day's candlestick. The previous day's candle can be negative or positive, it really.

How To Trade Blog What Is Three Inside Down Candlestick Pattern

1. The market must decline for a three outside up pattern to appear. 2. The pattern's first candle will be black, signifying a downward trend. 3. A large white candle will be formed next. It will be long enough for the first black candle to be completely contained within its true body.

Candlestick Patterns Explained with Examples NEED TO KNOW!

Overview The Precision PinBar and Bloom Pattern Concept by Zeiierman introduces two new patterns, which we call the Bloom Pattern and the Precision PinBar Pattern. These patterns are used in conjunction with market open, high, and low values from different periods and timeframes. Together, they form the basis of the "PinBar and Bloom Pattern Concept." The main idea is to identify key bullish.

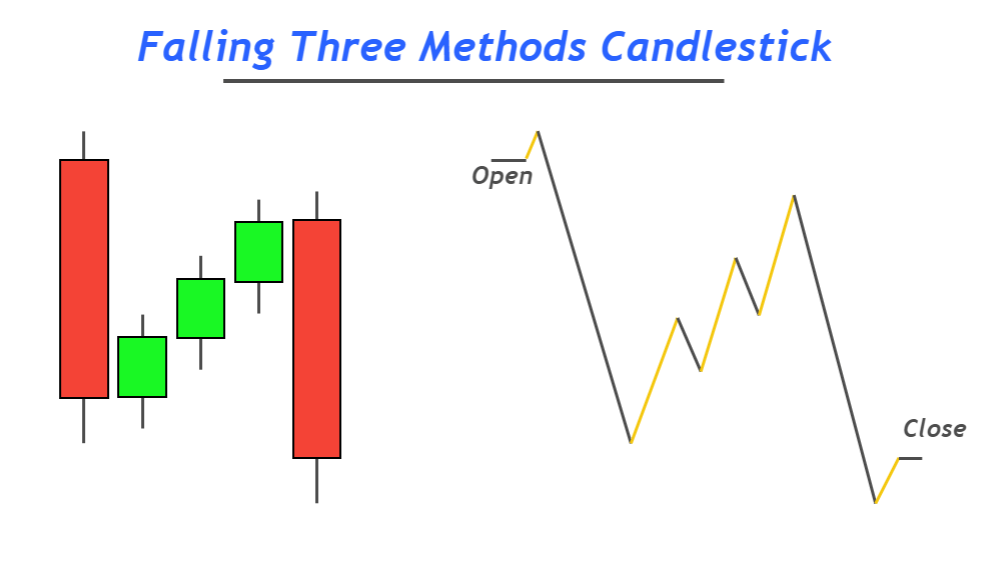

Understanding the Falling Three Candlestick Pattern in Trading — Hive

The third candle indicates an acceleration of the reversal. The three outside up / down candlestick pattern frequently occur and is a reliable indicator of a reversal. Traders can use these signals as major selling or buying signals but still watch for confirmations from other technical indicators or chart patterns.

Bullish Rising Three Methods Candlestick Candle Stick Trading Pattern

A tri-star is a three line candlestick pattern that can signal a possible reversal in the current trend, be it bullish or bearish. Tri-star patterns form when three consecutive doji.

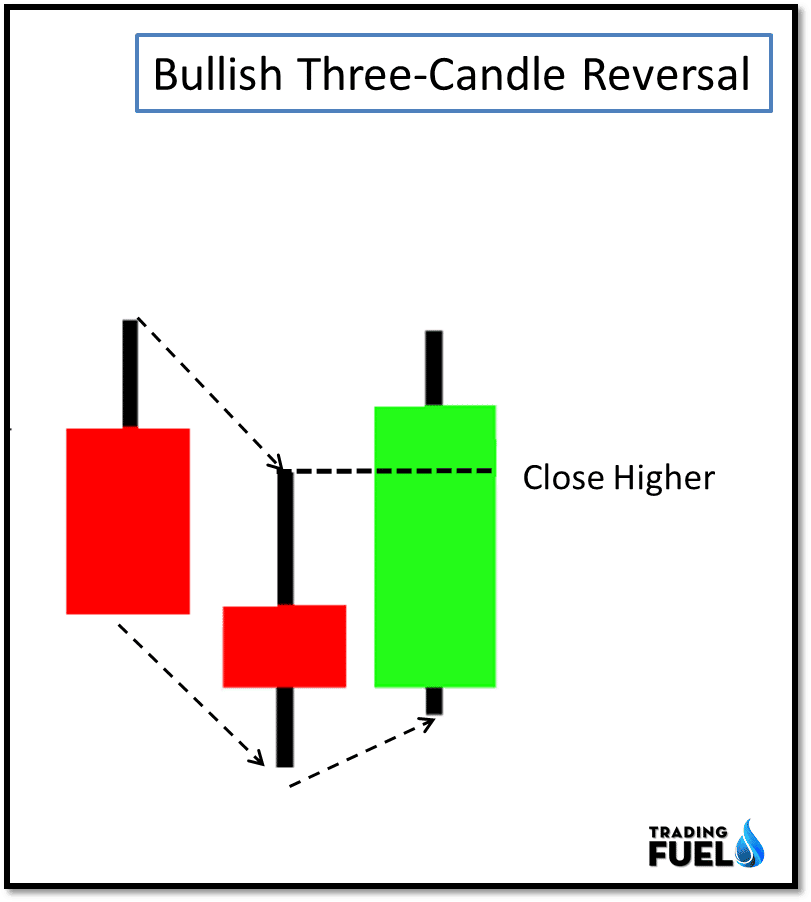

10 Price Action Candlestick Patterns Trading Fuel Research Lab

Piercing Pattern: 3. Bullish Engulfing: 4. The Morning Star: 5. Three White Soldiers: 6. White Marubozu: 7. Three Inside Up: 8. Bullish Harami: 9.

How To Trade Blog What Is Three Inside Up Candlestick Pattern? Meaning

The morning star pattern involves 3 candlesticks sequenced in a particular order. The pattern is encircled in the chart above. The thought process behind the morning star is as follow: The market is in a downtrend placing the bears in absolute control. The market makes successive new lows during this period.

How To Trade Forex Effectively With Three Inside Up Candlestick Pattern

The third candlestick is a bullish candlestick that should at least pass the halfway point of the first bearish candle. The morning star is a buy indicator. The evening star is similar to the.

What Is Three White Soldiers Candle Pattern? Meaning And How To Use

The Three Inside Up candlestick formation is a trend-reversal pattern that is found at the bottom of a DOWNTREND. This triple candlestick pattern indicates that the downtrend is possibly over and that a new uptrend has started. For a valid three inside up candlestick formation, look for these properties:

Bearish Candlestick Patterns Blogs By CA Rachana Ranade

It is a three-stick pattern: one short-bodied candle between a long red and a long green.

Three Candle Patterns Explained Part 1 YouTube

The 3 bar play is a common chart pattern characterized by three (or four) consecutive candlesticks that may appear in a downtrend, uptrend, or neutral market. Technically, although the pattern is known as 3 bar play pattern, it consists of four candles rather than three in some formations. Further, the 3 bar play can be either a trend reversal.

Candlestick Patterns The Definitive Guide (2021)

the three inside up and three inside down are reversal patterns. the first candle is long in the direction of the trend. the second candle is shorter and closes up to the half way mark of the first candlestick, indicating there is a change in momentum. the third candle closes beyond the open of the first candlestick. show less.

Candlestick Pattern Book Candlestick Pattern Tekno

Learn All 3 #CandlestickPatterns Analysis for ShareMarket Trading & TechnicalAnalysis in 3 Free Episodes.Open Free Demat Account on Angel Broking: https://bi.

An Overview of Triple Candlestick Patterns Forex Training Group

The three outside up is a bullish candlestick pattern with the following characteristics: The market is in a downtrend. The first candle is bearish. The second candle is bullish with a long.